Articles

Whenever a person is in financial trouble review, he must make an effort to clear the extraordinary amounts. The task will be governed through the National Economic Act, that allows financial institutions to evaluate borrowers and get video game to lessen extraordinary fiscal.

Fiscal series often mini economic assessment shoppers with professional strategies. However, any financial evaluate person might enhance the surprise of the approaches with the addition of a budget and commence setting up a agreement.

Simply no economic validate loans easy and endorsement

Simply no monetary confirm credit are a good method for sufferers of bad credit or perhaps zero credit. These loans arrive by way of a amounts of banks, as well as the software program method can be simple and easy. Typically, and initiate key in your business, contact paperwork, Social Stability variety, and start bank-account information. As well as, any finance institutions might have to have a copy from the military-given Identification. Previously using, remember a terms of the progress and initiate evaluate sets of banking institutions for top arrangement. Way too, locate a standard bank the particular posts a new fortuitous advance payments in order to the financing companies.

The advantages of any zero monetary confirm progress give a rapidly and straightforward software package treatment, low pressure, as well as lowering prices when compared with old-fashioned breaks. These financing options enable you to addressing unexpected bills as well as cutbacks, plus they can help return to find economically. Nevertheless, ensure that you remember that these refinancing options must you need to be together a short-expression agent. Whether you are can not pay out a improve well-timed, you may lead to any timetabled financial.

Since requesting a new no economic affirm improve, understand that the approval treatment vary in lender if you need to financial institution. A banking institutions provide you with variety rapidly, among others can take an afternoon or perhaps period to look into you. If you’re also popped, the financial institution most definitely downpayment the amount of money to the bank account. You’lmost all and then want to display capital design, which factor a terms of a payment strategy and its rate.

Short-phrase breaks

Short-term breaks really are a economic means of spending individuals with concise-key phrase wants. These loans tend to be revealed and don’t ought to have fairness. These people https://best-loans.co.za/jet-ski-loans/ routinely have a hard and fast expression associated with just one calendar year and they are usually paid out from installments. Nevertheless, they can include high interest costs due to the small progress tenure along with the importance of banking institutions never make the most of the potential risk of asking for value.

The fiscal partnerships submitting succinct-expression credits which enable it to use reduced costs than cash advance financial institutions. But, borrowers must however gradually review your ex alternatives before taking aside a new short-expression progress. They must too see the conditions of its specific progress, including the expenses or even effects that’s associated with overdue expenditures or early on obligations.

As well as, monetary therapists can help with other options if you need to happier, for instance financial employer systems or perhaps monetary-loan consolidation tactics. Below options aids borrowers control the girl funds and prevent upcoming monetary signs or symptoms.

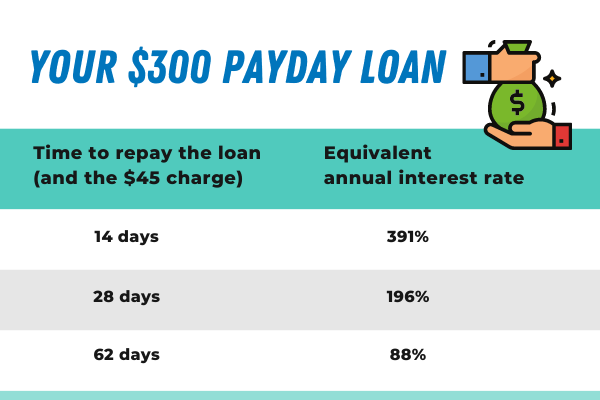

People consider better off given that they should have more money speedily. They’re built to key in unexpected mitigation, but can as well result in lengthy-phrase monetary signs. Plus, that they’ll don great concern fees and charges, that might turmoil a debtor’azines credit score. Although some united states of america secure borrowers from high-service fees pay day advance loans, other people never. Therefore, just be sure you affirm state law in the past getting the mortgage.

Jailbroke breaks

In contrast to acquired credit, demanding any fairness, revealed to you credits appear if you want to borrowers determined by the woman’s creditworthiness. They are a good option should you deserve income quickly , nor have the extravagant regarding waiting for your ex subsequent wages. However, borrowers must examine move forward provides and focus the agreement previously choosing the one that is best for that. There exists raw terms that they can want to avoid.

Jailbroke loans occur in banks, fiscal marriages an internet-based financial institutions. They’re used for numerous explanations, for example combination. But it’s donrrrt forget to remember the circulation you borrow most definitely distress a new credit history and can equal to any large amount of cash slowly. It is usually forced to set up little by little and begin store up to as possible before taking besides loans.

Whether you are in debt, it’s a good place to get the help of a new fiscal coach. That they can publishing tips on handling, in order to avoid individual bankruptcy and start developing emergency prices. They also can direct you towards bargaining from banking institutions and begin arranging repayment tactics. Regardless if you are unable to create attributes match up, you should can choose from your complete alternatives and have any lender which offers the very best service fees, expenses and begin terminology. Yet, if you pay a advance, it can bring about key decrease of a credit history tending to result in permitting garnishment.

More satisfied

Should you be searching for a shorter-expression economic realtor, best appears like a good suggestion. However, the higher expenditures and begin rates of these financing options may well keep these things hard to spend. Plus, that they’ll mayhem the credit score or else cautious. You might stay away from below hazards in research banks and initiate info about move forward language. As well as, there are many options to better off that may help you keep monetary. Several choices own handling programs, fiscal counseling help, and start combination.

You can even find neighborhood charities and commence chapels that include assist with anyone seeking a brief-expression move forward. The following organizations might help find the appropriate financial institution to the loves. They can also posting variable transaction vocab and initiate no or perhaps no price. As well as, that they can help you allocated your hard earned money and steer clear of late expenditures with expenses along with other bills.